04 Feb 2026

Bookkeeping is very important when it comes to managing your business finances. You are a startup, a small business that is growing, or a large business; proper and timely bookkeeping means that your financials are in check and your business is headed towards success. Working with professional bookkeeping will help you save time, minimize any errors, and see the important information about the financial state of your business.

The blog will cover the cost, procedure, and advantages of professional bookkeeping services in order to allow you to make a wise choice.

What Do Professional Bookkeeping Services Include?

The services of professional bookkeeping extend to various activities that are aimed at ensuring the accuracy, up-to-date, and organization of your financial records. These services generally include:

- Recording Financial Transactions: This will involve recording all business transactions that involve sales, purchases, receipts, and payments.

- Accounts Payable and Receivable: The management and monitoring of payments to suppliers and receipts from clients.

- Bank Reconciliation: It is necessary to reconcile your bank statements with your internal records and detect any discrepancies when they occur.

- Tax-Ready Bookkeeping: Organizing your financial records so they’re ready for tax filing, helping you avoid penalties and fines.

- Financial Reporting Services: Preparation of financial reports, including profit and loss statements, balance sheets, cash flow statements, and others, to provide you with a picture of your financial position.

- Expense Tracking Systems: Tracking and classifying your costs to have a clear idea of what you do with your money.

When you outsource your bookkeeping, you may be assured that your financial operations will be undertaken effectively, and you will have time to concentrate on the business.

The Bookkeeping Service Process

Professional bookkeeping is a process that is done in a series of steps, which will ensure that your business finances are well-managed. Here’s an overview of how the process typically works:

- Initial Consultation: You’ll meet with a professional bookkeeper to discuss your business needs, goals, and challenges. This helps the bookkeeper understand your business structure, industry, and specific financial requirements.

- Customized Plan Creation: Based on the consultation, the bookkeeper will create a customized bookkeeping plan. This may include choosing the right software tools (e.g., QuickBooks or cloud accounting solutions) and setting up your financial systems.

- Data Entry: The bookkeeper will start entering and classifying your financial transactions, sales, expenses, bank transactions, and receipts. This can either be performed manually or by automated means, depending on the tools utilized.

- Ongoing Bookkeeping: After it has been implemented, the bookkeeper will take care of the daily accounting, such as keeping track of your expenses, making payments, and keeping your books current.

- Regular Reports: You will get periodic financial reports, which can be monthly, quarterly, or annual reports of your financial status. These reports will allow you to follow your level of profitability, cash flow, and financial health.

- Tax Preparation and Filing: Professional bookkeeping services make sure that all the measures are taken and the records are arranged to be presented to file taxes. They can help in filing taxes when necessary.

- Continuous Monitoring: A bookkeeper will be constantly checking your financial dealings to keep everything in the right place and within the right regulations. This involves carrying out audits and detecting any discrepancies or mistakes that should be addressed.

Types of Bookkeeping Services

There are different types of bookkeeping services available depending on your business's size, needs, and budget:

- Outsourced Bookkeeping Services: Bookkeeping is one of the effective ways of saving time and resources by outsourcing the services. Under outsourced bookkeeping, an individual contracts the services of a professional team or service provider to manage all their financial work remotely.

- Online Bookkeeping Services: Online bookkeeping services are increasingly being embraced by most businesses because they are convenient and flexible. Cloud-based solutions enable owners of businesses to have access to their financial information from any location and at any time.

- Small Business Bookkeeping Services: Small businesses usually require cheap and simplified bookkeeping services to keep them under control and tax compliant. The offerings of these services are designed to suit the small business owners, from simple data entry to high-tech financial reporting.

- Virtual Bookkeeping Services: Virtual bookkeeping services are the same as the outsourced services, but these are performed through the Internet. They are cheaper and more adaptable because there is no need for in-house staff.

Bookkeeping Services Pricing

Pricing for professional bookkeeping services can vary significantly depending on your business size, the complexity of your financials, and the service provider. Typically, bookkeeping services are offered in different pricing structures:

- Hourly Rates: A number of bookkeepers charge hourly. The rate may be between $30 to $90 an hour on average, based on the complexity of the service and experience of the bookkeeper.

- Monthly Packages: There are also bookkeepers who provide fixed packages monthly. The packages are usually priced between $150 to $2,500 monthly as per the number of services offered, which can be transaction volume, financial reporting, and tax support.

- Project-Based Pricing: Bookkeepers can also charge flat project-based rates when it comes to single-time services such as clean-up or setting up bookkeeping systems. These projects may be between $500 to $5,000, depending on the complexity of the work.

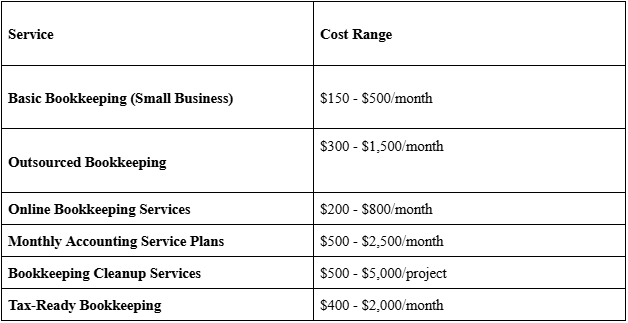

Here is a breakdown of the typical bookkeeping service pricing range:

How Much Do Bookkeeping Services Cost?

The cost of professional bookkeeping services can vary based on the complexity of your needs, the number of transactions, and the level of service required. On average, businesses spend anywhere from $150 to $2,500 per month on bookkeeping services. For small businesses, affordable bookkeeping services can often be found for $300 to $500 per month, which typically include basic financial tracking, expense reporting, and bank reconciliation.

For more advanced services, such as tax-ready bookkeeping and full-service accounting, you can expect to pay upwards of $1,500 per month, especially if you need ongoing consultation or comprehensive financial reporting.

Benefits of Outsourced Bookkeeping

Outsourcing your bookkeeping services comes with a variety of benefits, including:

- Cost-Effectiveness: It may be expensive to have a bookkeeper on board. Outsourcing bookkeeping would save your business money, particularly for small businesses, as you just pay for the services you require.

- Expertise and Accuracy: Professional bookkeepers possess the skills and experience to see that your financial records are clear, complete, and conform to the regulations.

- Time Savings: Outsourcing bookkeeping in business allows the business owners time to concentrate on other key areas of the business, like growth, marketing, and customer service.

- Scalability: As your business grows, you can adjust your bookkeeping service package to meet your changing needs without the hassle of hiring more staff.

- Improved Financial Insights: Frequent financial reporting brings you insights that are useful in making the right decision concerning the growth and direction of the business.

- Tax Compliance: Keeping track of tax-deductible expenses and ensuring your books are in order can reduce the risk of tax issues and penalties.

When Should a Business Hire a Bookkeeper?

A business should hire a bookkeeper if it experiences any of the following:

- Lack of Time: In case you or your team does not have the time to deal with the bookkeeping issues in an effective way, then it is time to delegate the task to a professional.

- Growing Business: Bookkeeping is complicated as your business expands. By hiring a bookkeeper, you are guaranteed proper financial records that are in compliance.

- Tax Season: When tax season is near, and you are overwhelmed with paperwork and receipts, a bookkeeper can assist you in getting everything in order and tax-ready.

Conclusion

Professional bookkeeping services can be used to keep proper financial records, as well as to ensure compliance and to help your business develop. Outsourced, online, or small business bookkeeping, it all depends on the process to guarantee that your financial records are organized.

Although the cost of bookkeeping services may not always be the same, you need to discover a service package that is affordable and meets your needs. Outsourcing your bookkeeping saves you time, lowers mistakes, and provides useful information that will lead your business to the next stage.